January 25, 2024 | Real Estate News

Interest Rate Holds Steady: Understanding Interest Rate Changes and Mortgage Options

In the wake of the Bank of Canada’s announcement to hold rates unchanged this week, discussions have intensified about potential decreases later this year. The consensus among leading bank analysts is that we will likely see interest rate decreases in the range of 1% by the end of this year, which would stimulate buyer activity. The interest rate forecasts also may prompt a reevaluation of the best mortgage strategies for you. This article delves into the impacts that interest rates have on the housing market and explores the considerations associated with choosing between variable and fixed-rate mortgages.

Background on Interest Rates:

Over the past 22 months, the Bank of Canada responded to a 30-year high inflation rate by elevating its policy rate from 0.25% in March 2022 to 5%. This led to higher prime rates and variable mortgage rates. However, with inflation cooling to 3.4% in December 2023, the decision to maintain current rates is expected to modestly impact home values. Although not triggering a sudden surge, it is likely to stimulate increased buyer engagement in the coming weeks.

Understanding Housing Market Dynamics:

Despite an unexpected spike in national home sales in December 2023, the Canadian Real Estate Association anticipates relatively stagnant growth in 2024 due to the lingering effects of higher rates. However, the potential for interest rate cuts could instigate a resurgence in sales.

Variable vs. Fixed-Rate Mortgages:

In light of the potential for impending interest rate cuts, homeowners may reconsider the viability of variable-rate mortgages. Over the past two decades, variable rates consistently outperformed fixed rates, providing homeowners with both flexibility and cost savings. Here, we analyze the distinctions between variable and fixed rates, exploring the advantages they offer in an environment of declining rates.

Key Contrasts Between Variable and Fixed Rates:

Payment:

- Fixed rates ensure a stable monthly payment.

- Variable rates fluctuate with the lender’s prime rate, impacting monthly payments.

Penalties:

- Breaking a fixed-rate mortgage incurs penalties based on the Interest Rate Differential (IRD) calculation.

- Variable-rate mortgages usually entail a 3-month interest rate penalty.

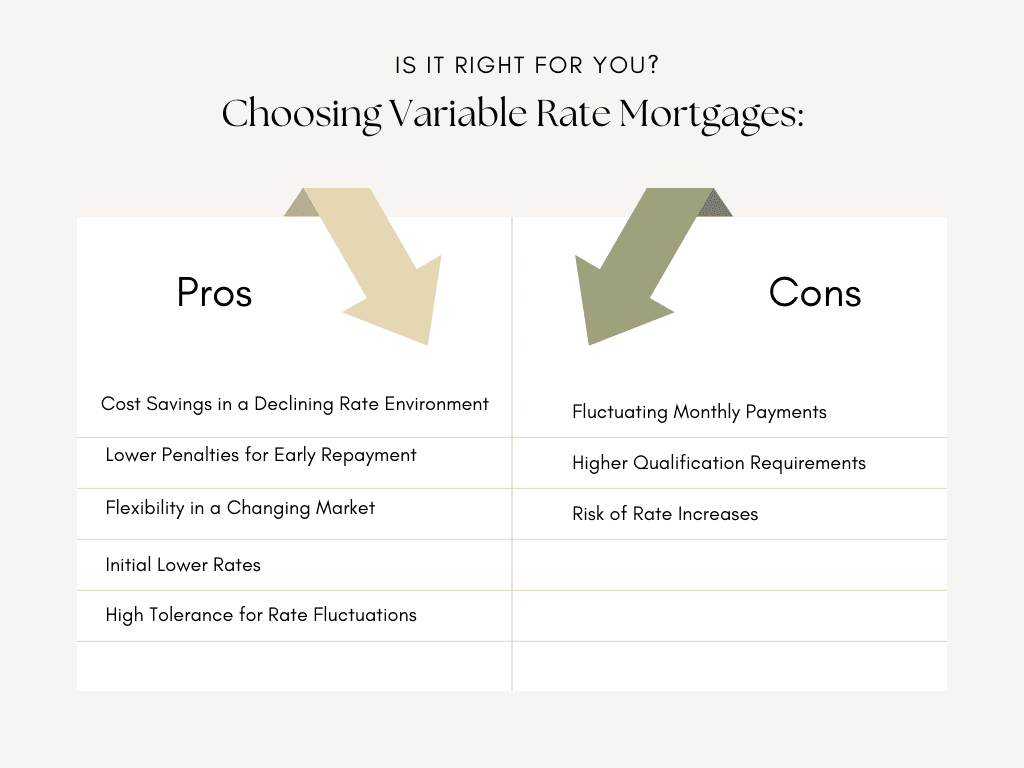

Choosing Variable Rate Mortgages:

Variable-rate mortgages come with several advantages, including cost savings in declining-rate environments and lower penalties for early repayment. Borrowers benefit from flexibility in adapting to changing market conditions, and historically lower initial rates provide increased budget flexibility for those comfortable with a certain level of risk. However, it’s essential to consider the downsides, such as fluctuating monthly payments tied to changes in the lender’s prime rate. These mortgages also often have higher qualification requirements, potentially limiting eligibility, and there’s a risk of higher payments if interest rates rise.

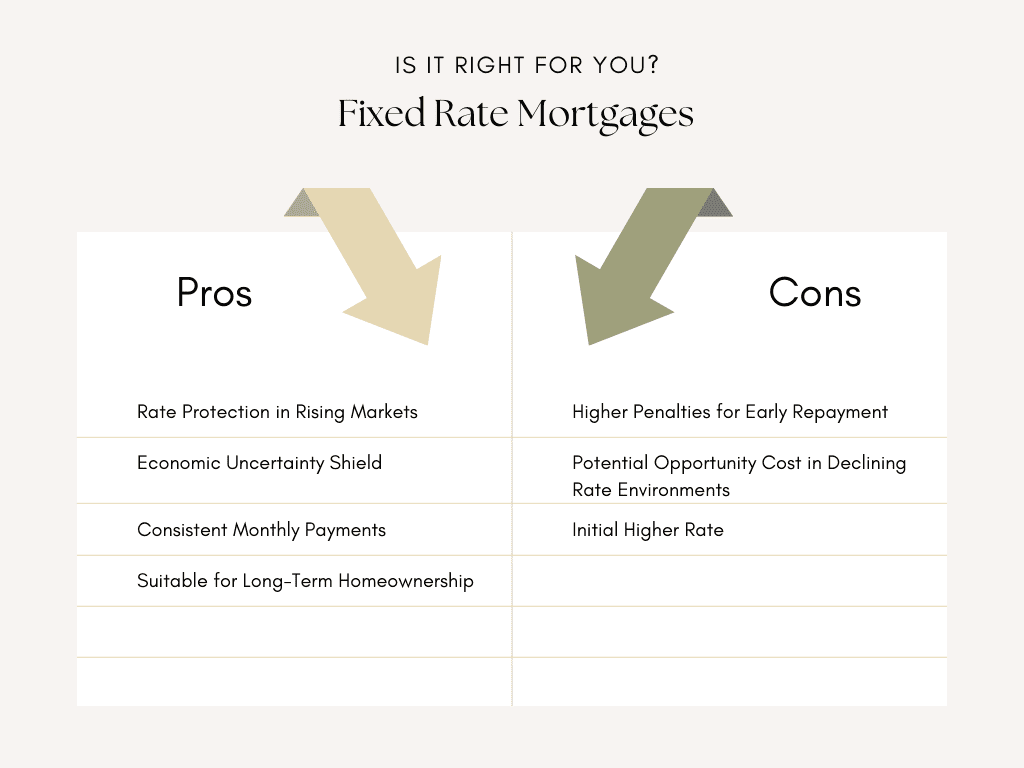

Choosing Fixed Rate Mortgages:

Opting for fixed-rate mortgages presents several advantages. In rising markets, these mortgages provide rate protection, shielding borrowers from future interest rate hikes. Fixed-rate mortgages act as a secure shield against economic uncertainties, making them an ideal choice for risk-averse individuals seeking stable monthly payments. Moreover, they align well with those planning extended periods in their homes, offering consistency and predictability in their financial planning. However, there are drawbacks to consider. Breaking a fixed-rate mortgage contract early often incurs higher penalties, impacting those who may need to terminate their agreements prematurely. In declining rate environments, there’s the potential opportunity cost of missing out on savings available to variable-rate borrowers. Additionally, fixed-rate mortgages typically start with initial higher rates, which may impact short-term budget considerations.

The decision between variable and fixed-rate mortgages hinges on individual financial goals, risk tolerance, and an assessment of potential advantages and disadvantages in the current market context. Opportunities for homeowners as rates decline with fixed rates include long-term predictability and a sense of financial security. Making informed decisions involves considering factors such as anticipating changes in ownership, timing market movements, leveraging low rates, building financial safety nets, and regularly reviewing and adjusting mortgage strategies. As mortgage professionals, our role is to assist in evaluating finances and running mortgage scenarios to guide individuals in making optimal decisions tailored to their unique circumstances.

Here at Urban Group Realty are always happy to chat through your options & connect you with the right people

Get The Newsletter

Join our mailing list to get updates from our experts about the Toronto market, the latest listings, and our industry insights.