August 2, 2023 | Real Estate News

Local Housing Supply Crisis

Home prices where we live here in Burlington, Oakville, Greater Hamilton and GTA are high. Unfortunately, the latest data in our report below suggests that we are headed for more scarce supply and likely higher prices in the long term. You may be thinking, oh wow, a realtor saying prices will go higher – what a surprise. But anyone that knows me personally knows that over the years I have called for increasing and decreasing markets based on my economics background and front-line experience. What follows below are some interesting insights, on a national and local level.

A few key themes:

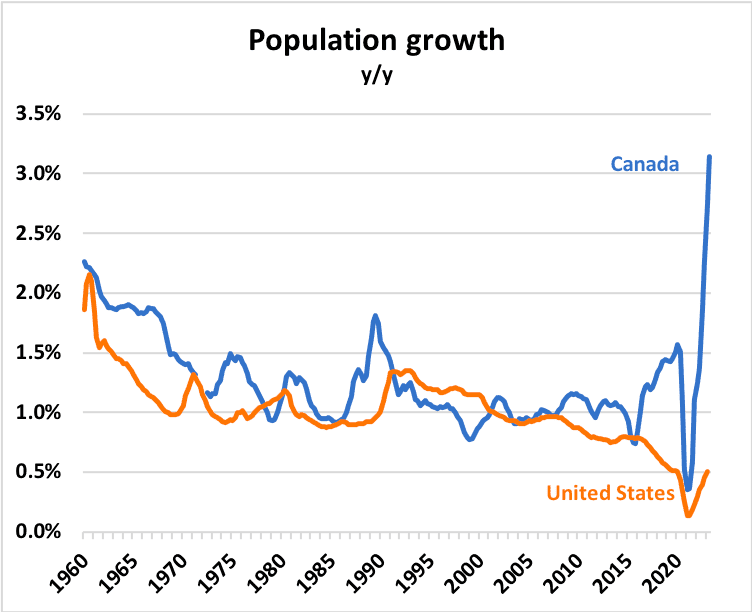

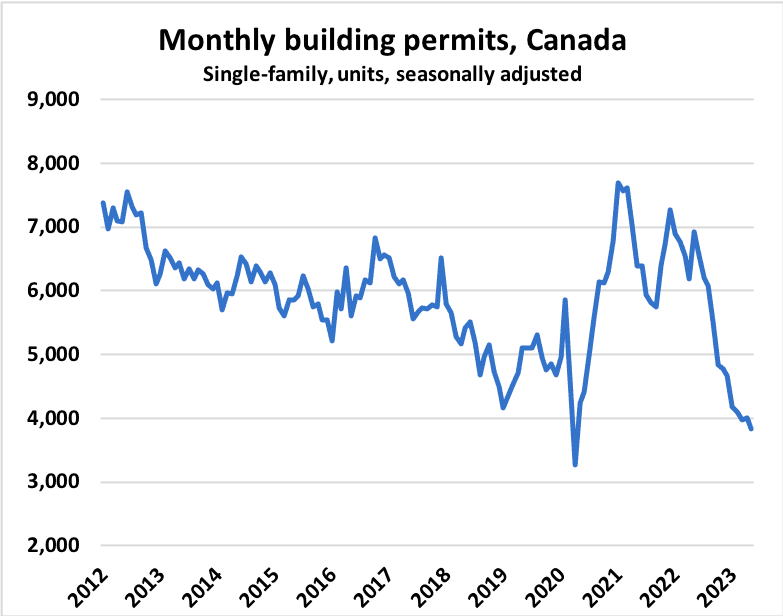

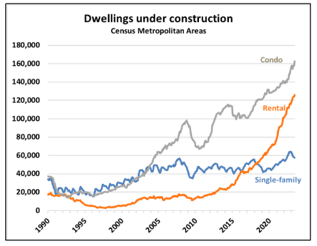

- Population growth is exploding, but we’re building fewer homes. Below are a few interesting charts from Ben Rabidoux.

This is not a case for less immigration. But rather it needs to be coupled with the proper balance of housing, infrastructure etc.

In the last year, Ontario’s population has grown by 504,618 people (and 1.2m nationally). During that time, Ontario built 71,838 homes. Almost half of them were apartment units. So, we are building one home for roughly every 7 people. And most of the building growth (46%) is from small condos and rentals – not the single-family homes that are needed.

- At the local level, we are way behind on building the homes needed:

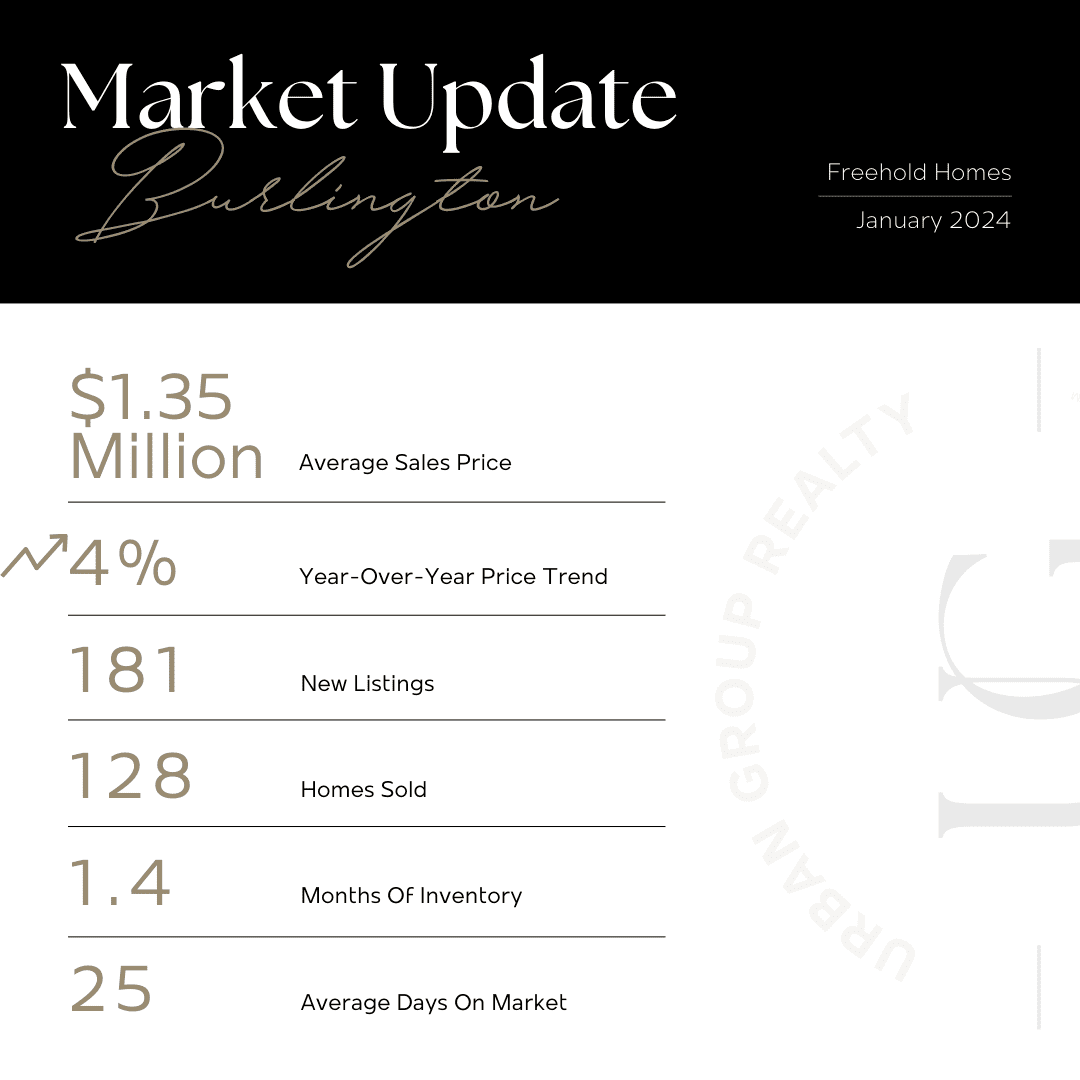

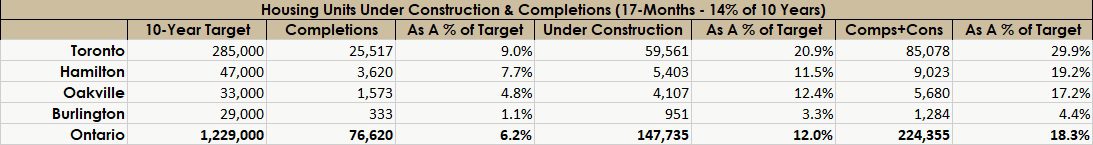

Several cities, notably Burlington, Oakville, Hamilton, and Toronto, are significantly falling behind their 10-year housing targets. This trend, accompanied by rising home prices and rents despite increasing interest rates, paints a concerning picture of the state of housing in Ontario.

Among these cities, Burlington is struggling the most. The city has a 10-year target of 29,000 homes, a goal they are far from achieving. With only 333 units completed, most of which are condominiums, Burlington has achieved a mere 1.1% of its target. This sluggish progress places Burlington at the bottom of the list, underscoring the urgent need for drastic changes to improve the situation.

Oakville, too, is having trouble meeting its housing goals. The city’s 10-year target stands at 33,000 homes. However, a stark contrast emerges when comparing the target to the reality – only 1,573 units have been completed so far, making up just 4.8% of the set target. As such, Oakville’s housing landscape presents a stark reminder of the challenges these cities face.

Hamilton’s performance has been slightly better, though still far from ideal. The city set a 10-year target of 47,000 homes but has only completed 3,620 units, which equates to 7.7% of the goal. Despite the city’s efforts to improve its housing situation, the numbers show that the struggle is far from over.

Toronto, Canada’s most populous city, is also falling behind. The city has a towering 10-year target of 285,000 homes. Yet, only 25,517 units have been completed, marking a 9% progression toward the target. Toronto’s situation further underscores the extent of the housing crisis across Ontario.

Interestingly, this lack of progress in new home completions is happening against a backdrop of increasing home prices and rents, despite higher interest rates. This seemingly contradictory scenario can be attributed to a variety of factors.

Supply and demand play a crucial role here. As the population increases and more people move into urban areas, the demand for housing continues to rise. This high demand, coupled with a lack of supply due to the slow completion of new housing units, is driving up both home prices and rents.

Moreover, housing is seen as a safe and secure investment, leading to more people investing in real estate, which further drives up prices. The rising interest rates make mortgage payments more expensive, causing more people to rent rather than buy homes, which in turn increases rent prices.

Increased rates have led to a pullback in pricing this year. However, unless we see significant changes in the near future, we are headed for more scarce housing. I think in the long term, houses in our area will be increasingly difficult to obtain, and we’ll likely see more of them converted to duplexes/triplexes to increase density and offset costs.

As we navigate this evolving landscape, it’s crucial to have accurate insights about your property’s value. Whether you’re thinking of selling or just curious about the value of your home, getting a professional home evaluation is a smart first step. Don’t wait to understand your home’s potential in today’s market. Book your home evaluation with us today.

Get The Newsletter

Join our mailing list to get updates from our experts about the Toronto market, the latest listings, and our industry insights.