May 15, 2025 | Market Reports

Where are Real Estate Prices Headed? Why ‘Months of Inventory’ Matters

You may be wondering what is happening with the real estate market. Are prices heading up or down? Although we don’t know the exact timing of future sales and price trends, the data points for the ‘months of inventory’ give us the best indication.

First, it’s important to remember that the long-term price trend in the past and future forecast for local and Canadian real estate has been upward.

The chart below, from the Canadian Real Estate Association (CREA), shows the residential average sale price in Canada historically (1980–2023) and forecasted through 2026.

This chart highlights one consistent theme:

While prices may rise or fall in the short term, Canadian real estate has historically trended upward over time.

- The blue bars reflect actual average prices from 1980 to 2023.

- The red bars show CREA’s forecast through 2026.

Even with recent market shifts and adjustments, the overall trajectory remains strong. This long-range view reminds us that real estate continues to deliver steady value for homeowners and investors alike.

What About the Short-Term?

Over the next 1–2 years, home prices will continue to be influenced by interest rates, affordability, supply and demand, population growth, and even political decisions.

We’re seeing different results across the board:

- Some neighbourhoods and property types are holding steady,

- Some are softening,

- And others are continuing to rise.

So how do we make sense of it?

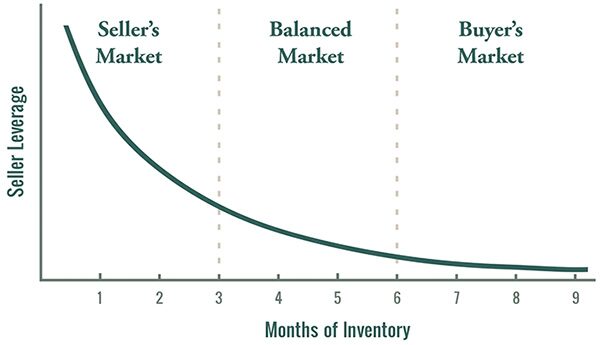

Are prices likely to rise, stay flat, or decline? Is our pricing right, or does the price need to be adjusted? The truth is, there’s a simple metric that cuts through the noise and tells you exactly where prices are likely headed next: months of inventory, often called MOI.

What Is Months of Inventory?

Months of inventory measures how many months it would take to sell every home currently on the market at the current pace of sales — if no new homes were listed.

- Sellers Market (1–4 months): Few homes, many buyers → Prices tend to rise.

- Balanced Market (4–6 months): Supply roughly equals demand → Prices tend to stay flat.

- Buyers Market (6+ months): Lots of homes, fewer buyers → Prices tend to soften.

In practical terms:

If your neighbourhood has 5 months of inventory, it means roughly 1 in every 5 homes will sell this month — and 4 will not. So what do we need to do to ensure we are the home that sells before the other 4?

That ratio (1 in 5) highlights the importance of standing out through price, presentation or marketing.

How MOI Drives Price

- Buyer urgency: In a low‑inventory market, buyers feel pressure (“I need to act fast!”) and often pushes prices up.

- Buyer lack of urgency: In a high-inventory market, buyers have lots of choices and seek the best value and terms. This often pushes prices down.

The Local Picture: Spring 2025 in Oakville, Burlington & Hamilton

Let’s look at current MOI in our three key markets, using CREA and board data:

Oakville

Freehold Detached

- Active Listings: ~950

- Last 30-Day Sales: ~180

- MOI: ~5.3 months

- What it means: Detached homes in Oakville are sitting in balanced-market territory, leaning slightly toward buyers. Homes need to be priced carefully and show well to stand out.

Freehold Town/Semi

- Active Listings: ~400

- Last 30-Day Sales: ~120

- MOI: ~3.3 months

- What it means: Towns and semis are in slightly seller-leaning territory. With lower inventory and steady demand, homes in this category especially those at entry-level price points are likely to attract strong attention.

Condominiums

- Active Listings: ~1,223

- Last 30‑Day Sales: ~114

- MOI: 10.7 months

- What it means: Condos face a deep buyer’s market in Oakville. Nearly one year of supply means pricing and incentives (rent‑back, closing flexibility) will be critical.

(Source: TREB April 2025 data, CREA aggregated Q1 condo MOI)

Burlington

Freehold Detached

- Active Listings: ~250

- Recent 28-Day Sales: ~55

- MOI: ~4.5 months

- What it means: Detached homes in Burlington are in a balanced market. Sellers should expect steady but selective buyer interest. Competitive pricing is key.

Freehold Town/Semi

- Active Listings: ~130

- Recent 28-Day Sales: ~40

- MOI: ~3.2 months

- What it means: Townhomes and semis in Burlington are sitting in a seller-leaning zone, with lower supply driving faster absorption. Entry-level and move-in-ready homes in this segment are moving well.

Condominiums

- Active Listings: 181

- Recent 28‑Day Sales: 22

- MOI: 8.2 months

- What it means: Burlington condos are clearly in a buyer’s market. Those looking to sell a condo will need competitive pricing and thoughtful marketing to stand out.

(Source: RAHB April 2025 board data)

Hamilton

Freehold Detached

- Active Listings: 510

- Q1 Monthly Sales: 137

- MOI: 3.7 months

- What it means: Hamilton detached homes sit in a balanced to slightly seller’s market. Well‑priced properties will still move quickly.

Freehold Town/Semi

- Active Listings: 245

- Q1 Monthly Sales: 77

- MOI: 3.2 months

- What it means: Townhomes and semis are in a slightly seller‑tilted territory—strong demand relative to supply.

Condominiums

- Active Listings: 485

- Q1 Monthly Sales: 68

- MOI: 7.1 months

- What it means: Condos in Hamilton carry a buyer’s‑market dynamic. Longer supply requires strategic pricing and potential incentives.

(Sources: CREA Q1 2025 breakdown by property type; RAHB March/April 2025 data)

What This Means for You

If You’re Thinking of Selling:

- Know your MOI.

- In Oakville (5.3 mo), expect buyers to negotiate, inspections to be thorough, and offers to come when the home is priced competitively vs other homes.

- In Burlington (4.5 mo), you can price near market value — but presentation and timing still matter.

- In Hamilton (3.7 mo),you can expect detached homes to command more, and condos may need sharper pricing or incentives.

- Set realistic expectations.

- In a buyer’s market, expect longer days on market and potential multiple price adjustments. Or consider pricing just below market value, and holding offers to determine the highest price and best terms in the current market.

- Stand out from the 80–85% that don’t sell this month.

- Price strategically (often a bit below average competitor).

- Invest in presentation (staging, professional photos, decluttering).

If You’re a Buyer:

- High MOI = more choices, more negotiating power.

- In Oakville, you can afford patience and may secure favourable terms.

- In Burlington, move decisively on properties you love — competition exists but is less fierce.

- In Hamilton, look closely at property types: condos face the most supply, detached and townhomes less so.

Next Steps

Whether you’re exploring a sale this year or simply tracking your home’s value, know your local MOI. It will help you:

- Set realistic price expectations

- Time your listing or purchase appropriately

- Understand negotiation power on either side

Curious what your specific neighbourhood’s MOI is right now? Reach out — we’ll pull the latest data for your street in Oakville, Burlington, or Hamilton, and walk you through what it means for your plans

Get The Newsletter

Join our mailing list to get updates from our experts about the Toronto market, the latest listings, and our industry insights.